Best Tips About How To Become A Cpa In Ga

![Georgia Cpa Exam & License Requirements [2022]](https://cpaclarity.com/wp-content/uploads/2021/06/cpa-requirements-georgia.jpg)

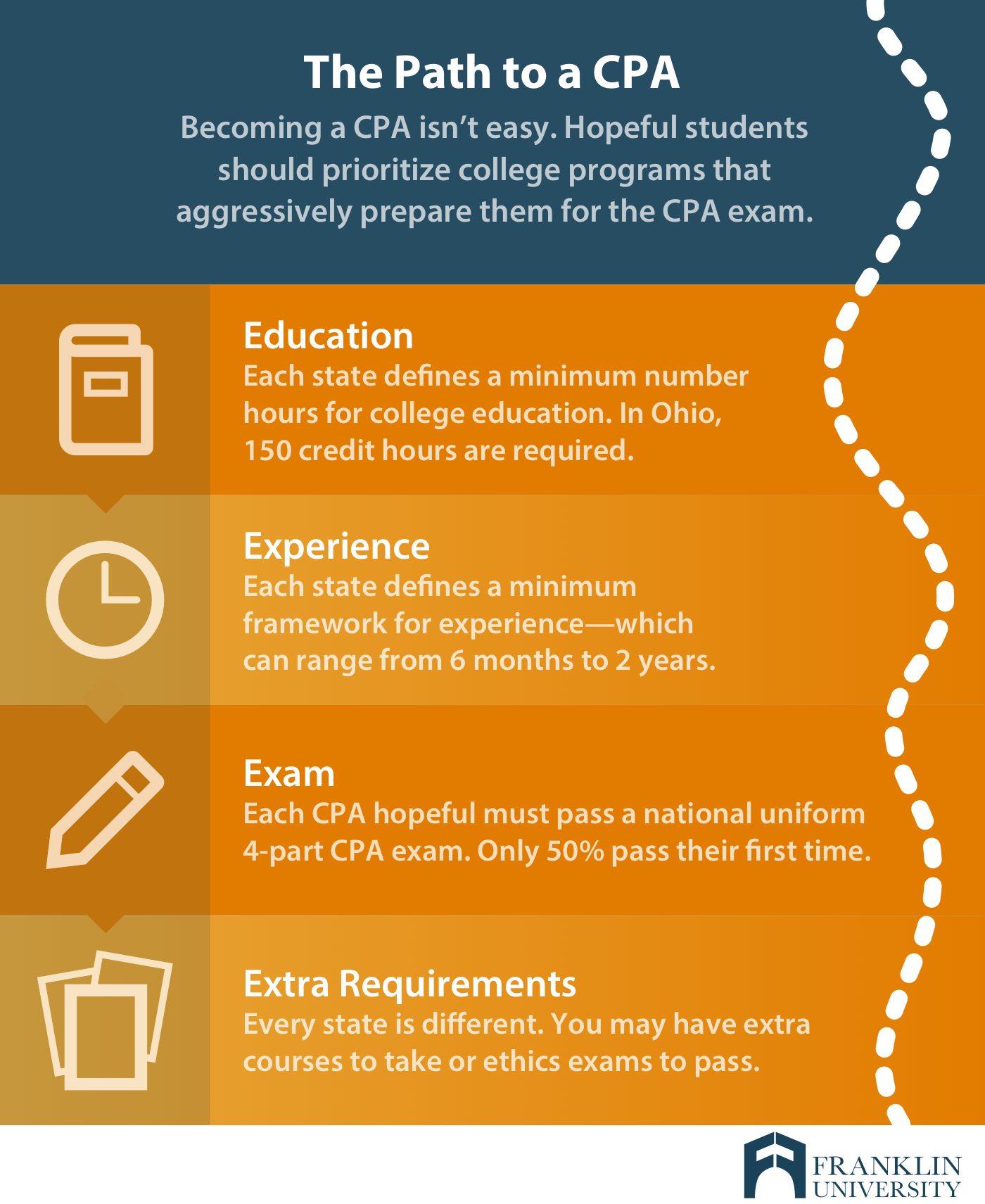

To become a cpa (certified public accountant) and to sit for the cpa exam, you need to obtain a bachelor's degree and complete 150 semester.

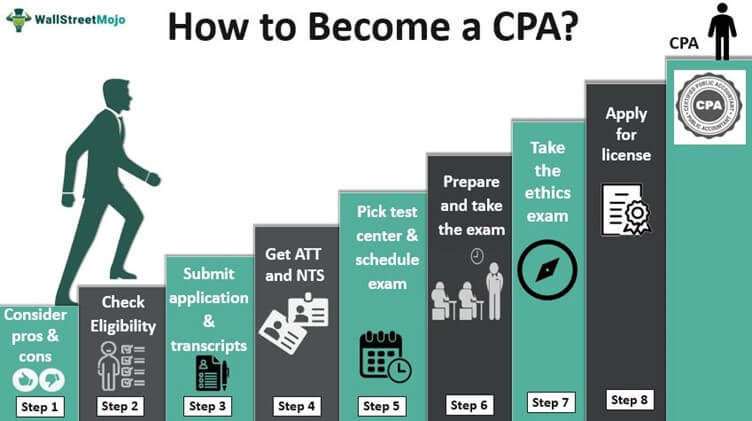

How to become a cpa in ga. Learn about cpa eligibility requirements in the state of georgia on this page. Gain accounting knowledge to help you become a cpa with an online bachelor’s. Qualifying for licensure in georgia.

In order to be eligible to sit for the ga cpa exam, you will have to have graduated from an accredited university or college with these minimum qualifications. Meet the eligibility and education requirements to sit for the cpa exam applicants who wish to be qualified to take the cpa exam will first need to pass Georgia’s certified public accountants hold bachelor’s degrees to meet minimum licensing requirements, but often go on to earn graduate degrees in order to earn the full 150 semester.

Cpa exam education requirements in georgia. Ad pass up to 4x faster with our adaptive technology. To sit for the cpa exam, you will need 120 semester hours of undergraduate coursework that includes a specialty or major in accounting.

Ask for the georgia coordinator. Passed the uniform cpa exam; 150 credit hours in accounting and business;

Learn the 7 simple steps to qualifying to become a licensed cpa in georgia: Click the button below to sign up for. Accumulate the required hours of.

Bachelor’s degree or higher) from an accredited college, university or foreign equivalent 30 semester. Ad pass up to 4x faster with our adaptive technology. For the full license, an additional 30 semester.

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-License-Requirements.jpg)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-Exam-Sections.png)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-Experience-Requirements.jpg)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-License-Education-Requirements.png)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-Exam-Eligibility-Criteria.jpg)

![Georgia Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Georgia-CPA-Exam-License-Requirements.jpg)