Favorite Info About How To Apply For Tax Filing Extension

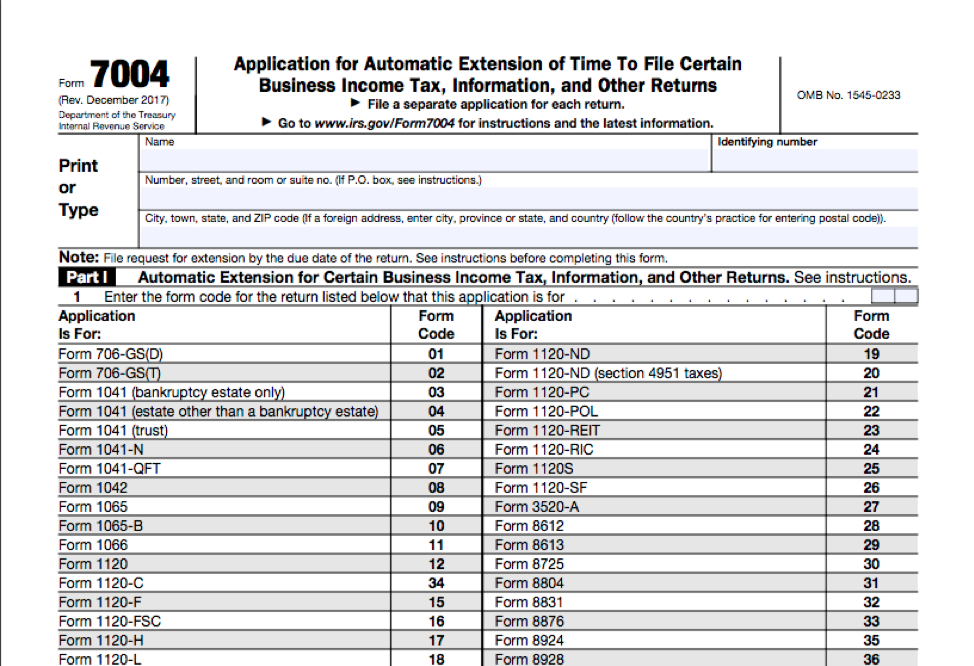

To do this, they should file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns.

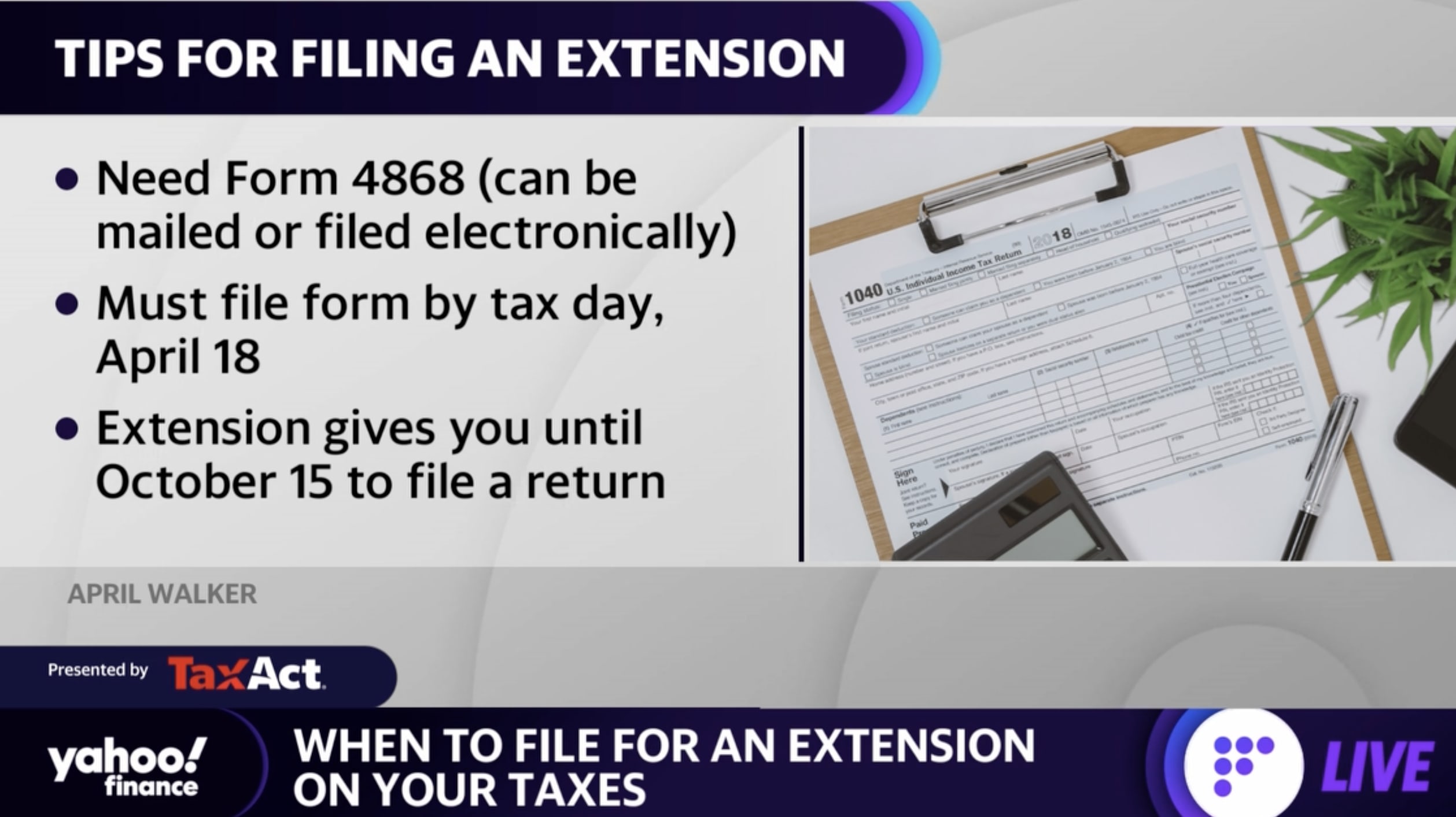

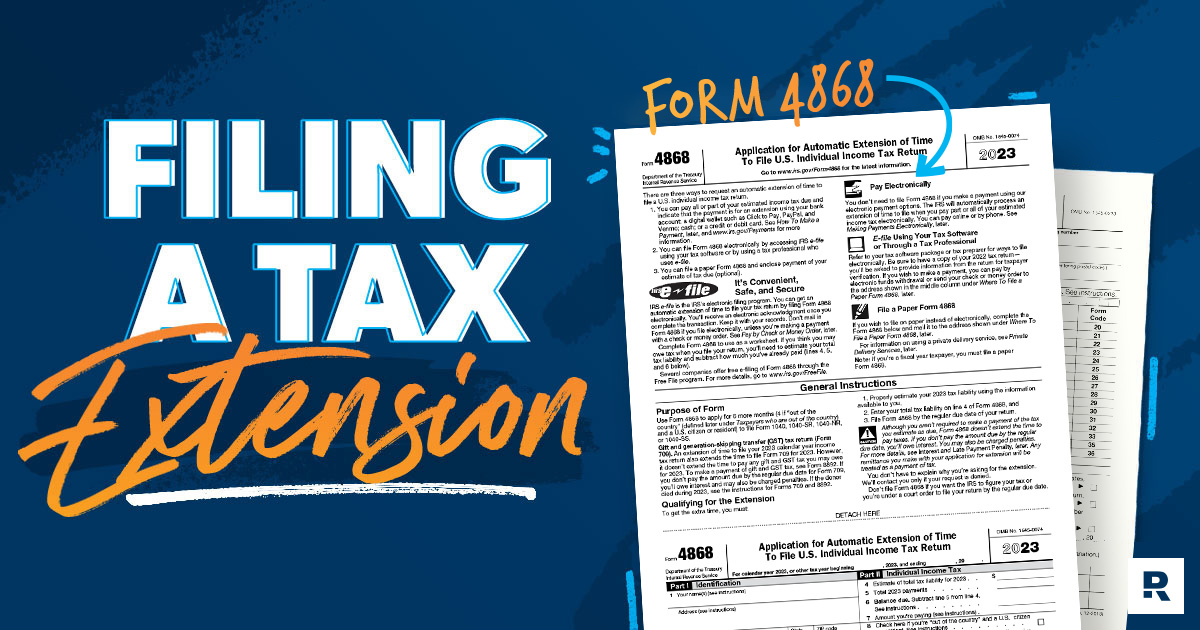

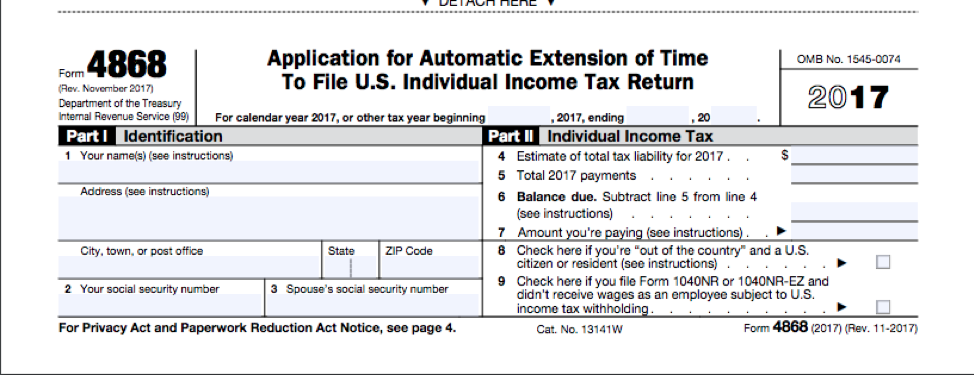

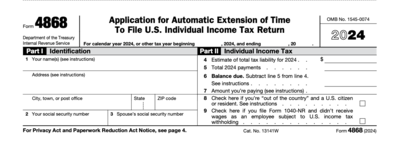

How to apply for tax filing extension. Up to 10% cash back select application for extension (form 4868) what happens when you file an extension for taxes. File electronically or print & mail. Enter tax year information and tax form details.

The estimated tax payment deadline for the third quarter is thursday, sept. To file a business tax extension, you or your chosen tax preparer should complete and submit form 4868 or form 7004, depending on the business entity you own. Up to 10% cash back taxact makes it easy to quickly file an income tax extension.

To request an extension to file your federal taxes after april 18, 2022, print and mail form 4868, application for automatic extension of time to file u.s. Create your free account and select form 7004 extension. There are a few different ways taxpayers can file for an extension.

But if a return is filed more than 60 days after the april due date, the minimum penalty is either $210 or 100 percent of the unpaid tax, whichever is less. This form requires you to select a code for the type of tax return your business. File for a tax extension with taxact by midnight on april 18 to have until october 17,.

Ad turbotax® can help whether you filed an extension or not. Two very important things happen when you request a tax. This means that if the.

If you need to file a tax extension for your business, file form 7004. Who needs to file, how to submit and more. The alabama business privilege tax is levied for the privilege of being organized under the laws of alabama or doing business in alabama (if organized under the laws of another state or.

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)